FUNDING SOLUTIONS

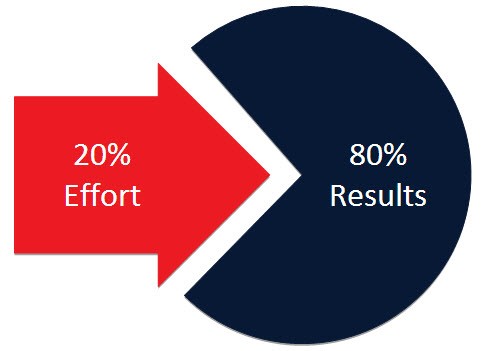

Pareto's principle, named for Italian economist Vilfredo Pareto, is well known as the "80/20 rule.” It holds the 80% of the results in any enterprise often come from 20% of the causes. In planned giving, there is a similar phenomenon. Most charitable giving follows a variation of the 80/20 rule:

- Most people hold their wealth in non-cash assets, such as stocks, bonds, cars, boats, personal real estate, commercial real estate, closely held businesses, gold, silver, royalties, copyrights, and patents, to name a just a few examples.

- Unfortunately, when these people donate money, they tend to write checks and give cash.

This creates the following problems:

- At the time when people want to sell any of the assets listed above, it may not be a seller’s market.

- The market for these assets may not be liquid: there may not be many buyers and sellers.

- If everything goes well, and people can sell their assets at profit, they will pay heavy taxes on capital appreciation.

As a non-profit 501 (c) (3) community foundation, Capstone can help you solve these problems through the various giving vehicles described on this website. If you have any questions, please contact us to discuss your situation. We can help you find ways to donate your non-liquid assets before selling them.