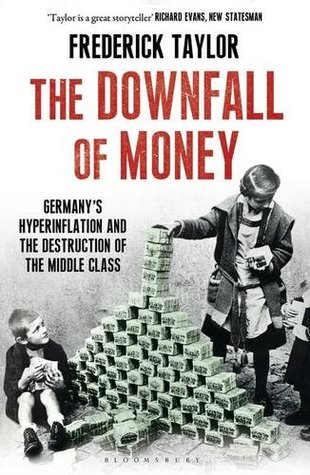

The Downfall of Money: Germany’s Hyperinflation and the Destruction of the Middle Class – A Book Review

Central banking doesn’t always make for the liveliest party chatter, but for those who want their work to endure seasonal economic shifts, it pays to think through complex historical scenarios.

To that end, it’s worth reading The Downfall of Money: Germany’s Hyperinflation and the Destruction of the Middle Class, a book by Frederick Taylor.

This book provides a window into one of the most extreme financial catastrophes in modern history, when Germany’s central bank wildly printed money, hoping they could inflate their way out of debt.

Businesspeople and investors worried about the possibility of rampant U.S. inflation won’t be comforted with a reminder of what happened a century ago. In 1913, Germany’s economy was vigorous, the second largest in the world after the U.S. Ten years later it was a hideous wreck, scarred by the costs of a lost war, and finished off by galloping inflation. Hitler and the Nazis got their start in this period of economic chaos.

Here are some of my takeaways:

In a nutshell, the German economy suffered tremendous inflation during World War One. When fighting broke out in 1914 between the European powers, Germany entered the conflict with a stronger army than her adversaries—but with a weaker economy. To finance foreign trade, the German government abandoned its monetary standard and confiscated gold and silver from its citizens, forcing them to use paper currency instead.

The paper currency immediately started depreciating in value. The most dutiful and patriotic citizens obeyed the government and handed in their precious metals, while many others hoarded their gold and silver despite extreme government attempts to pry it from them—including the use of schoolteachers urging children to spy on their parents’ cash supplies.

As the value of money plummeted, Gresham’s Law kicked into gear, which holds that “bad money” will always drive out “good money” as people spend their less valuable currency to buy things while hoarding more valuable money (gold and silver in this case) for their own future use.

German bank note printing during the war years caused severe inflation that reached 300% by 1918. This single phenomenon wiped out the fixed-income based savings of the educated middle/ upper-middle class “Bildungsburgertum” (academics, clergy, professionals, and bureaucrats) who had been running institutions and forming popular opinion since the 18th century.

Anyone relying on pensions or fixed incomes was rendered irredeemably poor. Anyone whose faith rested in the way things had been done in living memory was pauperized, especially those whom the old system benefitted most.

By contrast, those who were alert enough to recognize changing conditions and flexible enough to adapt were able to prosper, thrive, and even grow rich in one of history’s most sudden and astonishing wealth transfers. The ensuing social disruption followed the “loser now will be later to win” lyrics of the Bob Dylan song The Times They are A-Changin.

In rural areas, country bumpkins who had often been marginalized and mocked by the urban elite traded their farm goods for gold, silver, jewelry, and other precious heirlooms to city dwellers desperate to eat. Bread, milk, and eggs reached premium prices. Fresh access to food put farmers in the drivers’ seat as the value of money unraveled. Soap, an essential for scrupulously clean Germans, became scarce and therefore soared in value. Everyone in society had an incentive to hoard toiletries, shoes, clothing, and coal (for winter heating).

By 1919 the government, already drowning in heavy wartime debts, was pushed further down by war reparations demanded in the Versailles Treaty.

This external pressure occurred as soldiers returned from the front mentally processing the shock and tragedy of the prior four years. Many Germans sought ways to recover their own private war losses by gaming the welfare system. Families claimed extra members while double dipping into multiple dole offices that didn’t keep common records.

As citizens gamed the government, the government gamed the people. The government confiscated people’s money not through more taxes, which would have been politically impossible, but through the hidden tax of inflation.

The central-bank currency-devaluing process that started with the war now assumed grotesque proportions. For example, opera and tram tickets started changing prices weekly, and eventually daily.

Other nations struggled to rebuild from the war, but German exports soared. As domestic money got cheaper, people around the world bought high-quality German products at bargain-basement prices. The manufacturing sector paid high wages to their workers but they also raised domestic prices to keep up with inflation—which fueled further inflation.

Anyone receiving royalties, rents, or any other form of fixed income saw their earnings disappear. But anyone agile enough to move between paper money, hard currency, and physical goods reaped fantastic success. For example, one German student put himself through Heidelberg University by working summers in a Netherlands coal mine to pay his German tuition in Dutch guilders.

Consider the incredibly opportunistic Hugo Stinnes, a manufacturer who surfed the Weimar Tsunami by borrowing money to the hilt from his customary bankers, using their money to buy income-producing coal, iron, and steel assets from panicking sellers, and then using profits from these assets to repay his bank debts with ever cheapening money. He would also export German goods abroad for foreign cash, and then hoard this cash in other countries to avoid domestic taxes while providing self-insurance against further monetary deterioration at home. He could then repatriate his money at will to buy more and more businesses, plants, and machinery at ever cheaper prices.

Bankers were among the biggest losers. In a debt jubilee of biblical proportions, banking deposits shriveled as people discovered there was no point saving money that would only waste away. Homeowners saw their mortgage payments shrink by the month and even by the week.

In this climate it became essential to earn new money and not rely on savings.

Equities did quite well when their underlying businesses where able to profit from inflation and gain access to foreign capital. Life was good for the young and nimble, and for visiting tourists with foreign cash. But slow-moving reliance on previously successful experience was brutally penalized with poverty, bankruptcy and even death.

Amazingly, through all this time Germany remained the world’s second largest economy.

Observing the hyperinflation from London, John Maynard Keynes observed that inflation allows governments to confiscate money secretly from people without the need of resorting to unpopular taxes.

From the standpoint of asset management, the German hyperinflation shows that there are times when it is impossible to retain wealth through buying and holding. Such conditions favor active businessmen, and they penalize patient savers. In such seasons, patience isn’t a virtue.

I hope this description of things I learned from Taylor’s book provides enough detail to inspire others to read it or listen to the audio version. It’s a fascinating story, and it provides a good case study to put yourself in a framework to think about how you might respond if America ever experiences a monetary wrecking ball of similar magnitude.[1]

Such an event needn’t be hyperinflation. A season of DEFLATION could be equally disruptive if central bankers over-react to deflation with too much fiscal stimulus in response. The more interesting point is to consider what the world would look like if, for whatever reason, a majority of people collectively start losing faith in money itself. It’s happened before.

This review was written by G. Andrew Meschter.

[1] Actually, such a scenario occurred during the American Revolution when the unbacked paper “Continental dollar” lost so much value that it took 50 to 100 “Continentals” to match one gold dollar.